This post may contain affiliate links. If you click on an affiliate link and buy something, I get a percentage of the sale. Find out more by reading my affiliate policy and disclosure.

Money is hard.

There. I said it.

In theory, it’s very easy. They key thing is to spend less than you earn.

However. In reality, we don’t have total control over how much we earn. And we all need to spend money to survive.

If we consistently spend more than we earn, we go into debt, and eventually end up bankrupt.

If we consistently earn more than we spend, we eventually build up enough savings that we achieve ‘financial independence’. This is a desirable state when your income no longer hinges on needing to work a job. That enables you to retire and sustain a comfortable standard of living.

Most of us float somewhere between those two poles.

Why spend less than you earn?

The earlier you can start building up a savings account, the better off you will be.

Savings do two things:

Firstly, savings provide a buffer for times when your income goes down – perhaps due to sickness, an accident, retraining or a period of unemployment. This is where the idea of an emergency fund comes into play. It stops you from living paycheck to paycheck and (should the worst happen) buys you some time to create a plan to deal with it.

Secondly, because of the magic of compound interest, the earlier you put money away, the more money it makes you.

What is the magic of compound interest?

Basically, if you put a small amount of money into savings early on, the interest rate compounds over time. In other words, if you save every month for 10 years from the age of 21 to 31, you’ll actually end up with more money than someone who saves the same amount each month for 40 years between the ages of 30 and 70. (See more at The Telegraph)

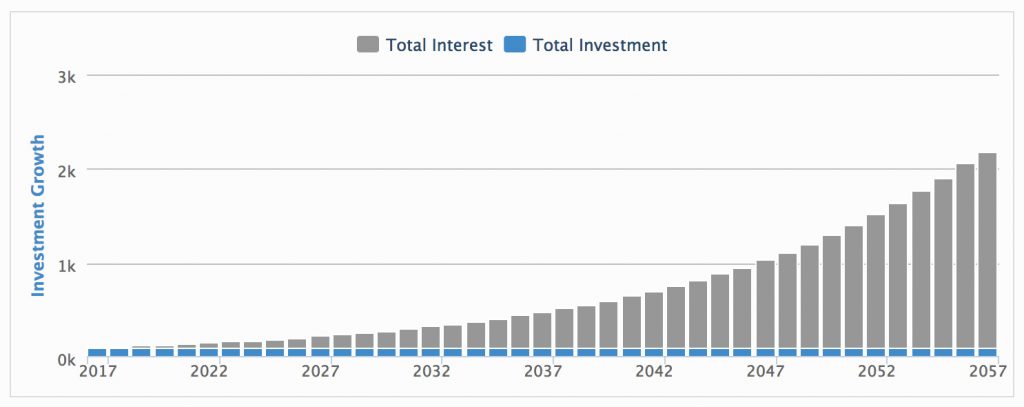

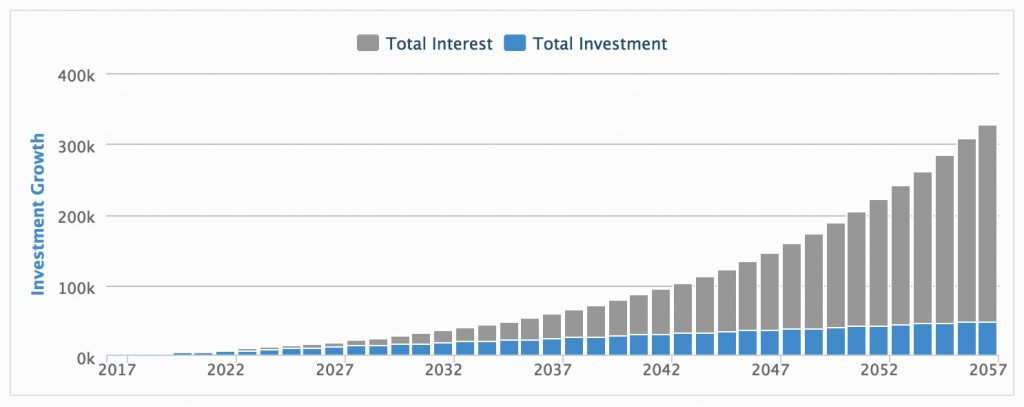

Here’s a visual example of compound interest at work.

If you save £100 at an interest rate of 8% and do nothing else for 40 years you’ll end up with over £2,000.

If you save £100 a month at 8% for 40 years? You’ll end up with over £300,000.

Want to see what’s possible? Have a play around with the compound interest calculator on this website.

Compound interest works against you if you are in debt

Just imagine that graph working against you if you borrow money. For example, if you borrow £100 at an interest rate of 8% and don’t pay it back for 40 years, you’ll end up owing over £2000.

However, credit card interest rates average at about 15%! That means if you borrow £100 and don’t pay it off for 40 years, you could end up paying £752,216 in total.

Borrowing money is very, very expensive.

If you do carry credit card debt, two of the best things you can do for yourself are:

- Stop spending on it.

- Transfer your balance to a card that offers a 0% introductory offer on transfers.

Use this card costs tool to calculate a debt repayment plan taking into account how much you owe now, and how much your debt will cost you over time.

How to spend less than you earn

The first step before making changes is to understand the current state of your budget.

This means writing down everything you spend and everything you earn. I’ve written a guide about how to make a budget, which covers everything you need to do to create an accurate forecast of your spending.

It’s easy to do two things when you write down all your income and expenses like this:

- You ‘fudge’ a little and conveniently forget one-off, small purchases,

- You feel bad and guilty for how much you spend.

Unfortunately, money is an emotionally charged subject for most of us. Our wealth is tied to our class, our status, our sense of security, our sense of worth. We are raised with many contradictory ideas around money, ranging from ‘treat yourself, you might die tomorrow‘ to ‘spending money on fripperies is wasteful and selfish‘.

It’s therefore helpful to remember this:

Money is a tool.

Specifically, it is a social construct that allows us to exchange goods and services in a (relatively) efficient way.

Now, money is an improvement over a barter system where you had to find someone who had what you wanted and convince them to exchange it for a thing that you had. However, because money is an abstraction of value, it’s also easy to forget what it’s worth. We spend three hours earning £30, and then spend £30 on a dinner out.

What we forget is that we could’ve spent one hour making dinner and had something a lot nicer.

A good book to read about this is Your Money or Your Life*.

Effectively this book asks you to think about money in terms of time. So if you earn £10 an hour, every time you spend £10 you have effectively exchanged it for an hour of your life.

How you choose to spend your money is totally up to you. However, it will make you happier if you choose to spend your money with intention.

This means that you choose to allocate your money to the things that bring you the most value. (The things that bring you most value are probably the things that make you happy, healthy and wise.)

Another thing to remember is this:

We live in a capitalist economy.

Those interest graphs above? That’s a direct example of how already having money allows you to earn more money. If you are very poor, it is almost impossible to extract yourself.

Money flows towards those that have capital, and away from those who live paycheck to paycheck.

It is what it is – this isn’t a post where I am going to debate the moral foundation of our society. The fact is, we live in this society and we all need to do what we can to look after ourselves and our loved ones.

Spend less than you earn: maximise your earnings

There are two variables we can influence: how much we earn, and how much we spend. Most of us focus on reducing the amount we spend. Our expenses feel more in our control, we can make quicker changes to our budget by spending less, and it’s relatively easy.

However, it’s also important to look at how to maximise what your income is. Things you can do include:

- Ask for a raise,

- Pick up overtime,

- Discuss opportunities for a promotion,

- Look for a new job,

- Change to a higher paying career,

- Earn money on the side,

- Claim all benefits that you can.

Now, there are many pressures that can affect our ability to earn. We may not have the physical or mental health needed to pick up more hours or find a different job. We may have huge pressures on our time because we are caring for dependents.

However, it’s important to focus on what you can do rather than on what you can’t do.

I was raised in a pretty entrepreneurial household. I remember my Dad bringing back gizmos from the factory he worked at which we would work on as a family, soldering the wires and screwing them together in a little family-orientated production line.

I’m not saying you need to put your children to work. I’m saying look for ways you can make earning more money work with your situation, and try and make it less stressful and more fun.

Spend less than you earn: cut back on your spending

Cutting back on big ticket items like housing costs frees up money for the things we really value. Consider downsizing the following items:

- Move to a smaller/cheaper house, apartment, flat share, or consider alternative living arrangements.

- Move to a cheaper city.

- Get rid of your car.

- Negotiate all your subscriptions and bills.

- Cancel anything that doesn’t bring you value for money (cable TV? Netflix? Gym membership?)

I’ve written a detailed guide that goes in-depth on how to cut back your spending.

Understanding the psychology behind spending less

For me, the realisation that I was trading my time for stuff I didn’t really need was a big shift in how I thought about money.

However, your spending might be rooted in something else. Maybe you spend money on clothes you’ll never wear, or pretty things for your house when your house is already cluttered to the rafters. Maybe you buy takeaway all the time, despite pledging that you wouldn’t.

If you regularly find yourself blowing your budget, it’s time to start thinking hard about your mind set.

What triggers a bout of overspending?

Do you get stressed and overwhelmed and buying something helps you feel in control?

Or maybe you have a lack of time or knowledge. If you don’t know how to cook, let alone how to plan a weeks meals, you won’t be able to go from eating takeaway four times a week to cooking every meal at home from scratch.

Perhaps you shop because you want to feel like you matter, or like you exist.

Or maybe shopping is a little bit of self-destruction. Deep down, you don’t feel like you deserve to have money.

The truth is, you probably already know how to save money. But implementing what you know? That’s the difficult part.

There are three things that can help you tackle your mind set:

Understand your triggers and create ‘alternative habits’. So if a bad day at work leaves you feeling out of control, find a different coping method than shopping. Try taking up a craft like knitting. Consider going for a long walk before pulling out your credit card. Or maybe you create a giant rubber band ball. It doesn’t matter what it is, as long as it is something that fulfils the same basic function as shopping. So you need to understand what it is you really enjoy and get out of the experience.

Create a Plan A and a Plan B. So you’ve decided to stop buying takeaway. Good idea – it’s expensive and often high in calories, fat and salt. However, whilst your Plan A might be ‘cook dinner every night’, your Plan B might be ‘keep some ready meals in the freezer’. This way, if you run out of time, energy or ingredients, you’re not completely stuck.

Change the triggering situation. If a phone call with your mother always leaves you with low self-esteem and an urge to self-destruct, consider not calling your mother anymore. (You could consider emailing her instead, if you find it easier to deal with.) If a long commute leaves you too exhausted to contemplate cooking, then move house so you are closer to work (or get a job closer to home).

Some really good points, especially where you talk about equating your time with the cost of something, it really changes how you choose to spend money.

Yes, definitely. I’ve been thinking a lot about how time/energy/money all interelate! I sense a longer, more philosophical blog post coming…

Thanks for commenting 🙂

I think I’m pretty good with money – I’m not materialistic so I generally don’t spend a whole lot of money except in essentials. I really need to start looking into investment opportunities though and start making my money work for me.

Great post

Debbie

Not being materialistic is the best way to be. There are so many other ways to bring happiness into your life, beyond just buying stuff!

Really good points. I’m slightly terrified of how much my credit cards will cost over my lifetime!

Yeah, CC debt is a killer. I have some cc debt, though on a 0% card which I am paying off before the offer expires.

Has to be said though, I’d rather be putting that money into savings!

I love the tone of this and the practical advice. Great post!

I used to go shopping for entertainment. But then I would give in to the temptation to buy things because they were right in front of me! Staying away from the temptation in the first place by finding other fun things to do has helped me rein in my spending.